For many people, the clock striking midnight on New Year’s Eve represents a new year of possibilities. It also means the end of a fiscal year, which means tax season is just around the corner. It won’t be long before everyone starts getting their W2s, and Uncle Sam will ask for his share of their earnings.

While it’s always advised to work with a tax professional, here are three infographics that will help you file your taxes for 2022.

How U.S. Taxes Work When Filing Taxes for 2022

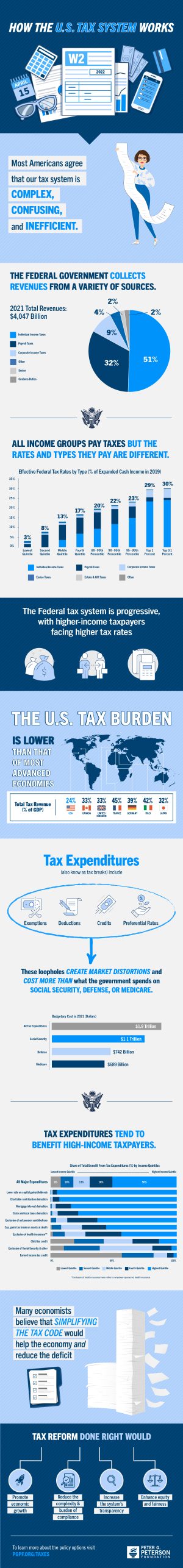

The Peter G. Peterson Foundation aims to increase public awareness of financial challenges facing the USA. This nonpartisan organization dedicates its mission to building a better economic future for everyone. The goal of this infographic is to show just how complex the U.S. tax system is and to suggest simplifying the tax code to make it more accessible and to reduce the national deficit.

What Is an Income Tax Return?

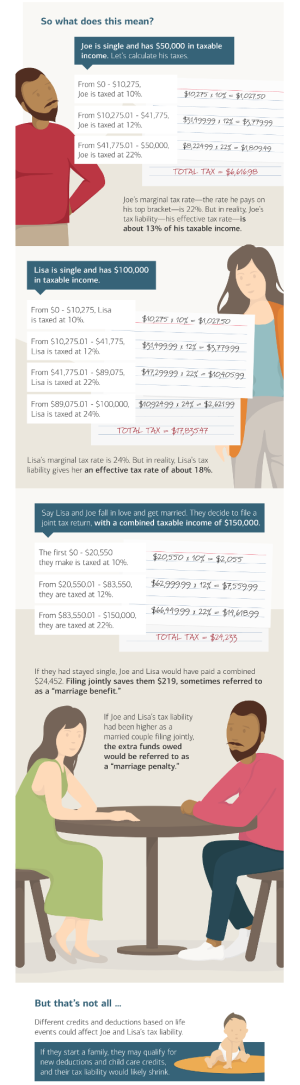

Bank of America believes in helping its customers make better money habits. Part of getting better with money means understanding how income tax is calculated and why some people get an income tax return, and others don’t.

This infographic shows tax brackets for single and jointly filed married couples. It also breaks down how these brackets work, including the difference between a tax bracket and an effective tax rate. U.S. tax policies are extremely complicated, but this infographic helps clear up some of the common misunderstandings.

How to Reduce Your Tax Burden

One way to reduce your tax burden is to reduce your adjusted gross income through deductions. For families, this could mean getting tax credits through things like dependents. If you’re wondering, “when filing taxes, what is a dependent,” there is a simple test:

- The person is not a qualifying child of a taxpayer: not being claimed as a dependent by someone else

- They earned less than $4,300 in taxable income in 2022

- They did/could not provide their own support, which means you supply more than half of their support for the year

- Live with you as a member of your household

While the Newgate School isn’t in the business of taxes, they do help young adults support their own dependents. This school offers tuition-free vocational training for at-risk adults and helps them find meaningful work in the automotive industry. Since the Newgate School relies on used car donations to keep the school running, they do know a thing or two about reducing your tax burden. For example, a used car donation can be used to lighten your tax load. They created an infographic that breaks tax reduction efforts, including donating to charity.

Final Thoughts

While the U.S. Tax Code may be complex, you’re not alone. You can find plenty of resources online that help you understand new tax laws and how to get the most from tax day. Of course, you should always consider working with a professional tax preparer, especially if you are a higher earner, have a complicated income, or want to make large donations. Otherwise, if you take some time to dig into tax laws, you’ll be all set when Uncle Sam comes knocking.